Bill Hale

I am a writer, deeply immersed in the world of collecting and reading, where my passions and creative endeavors have converged to birth the creation of Ageless Literature.

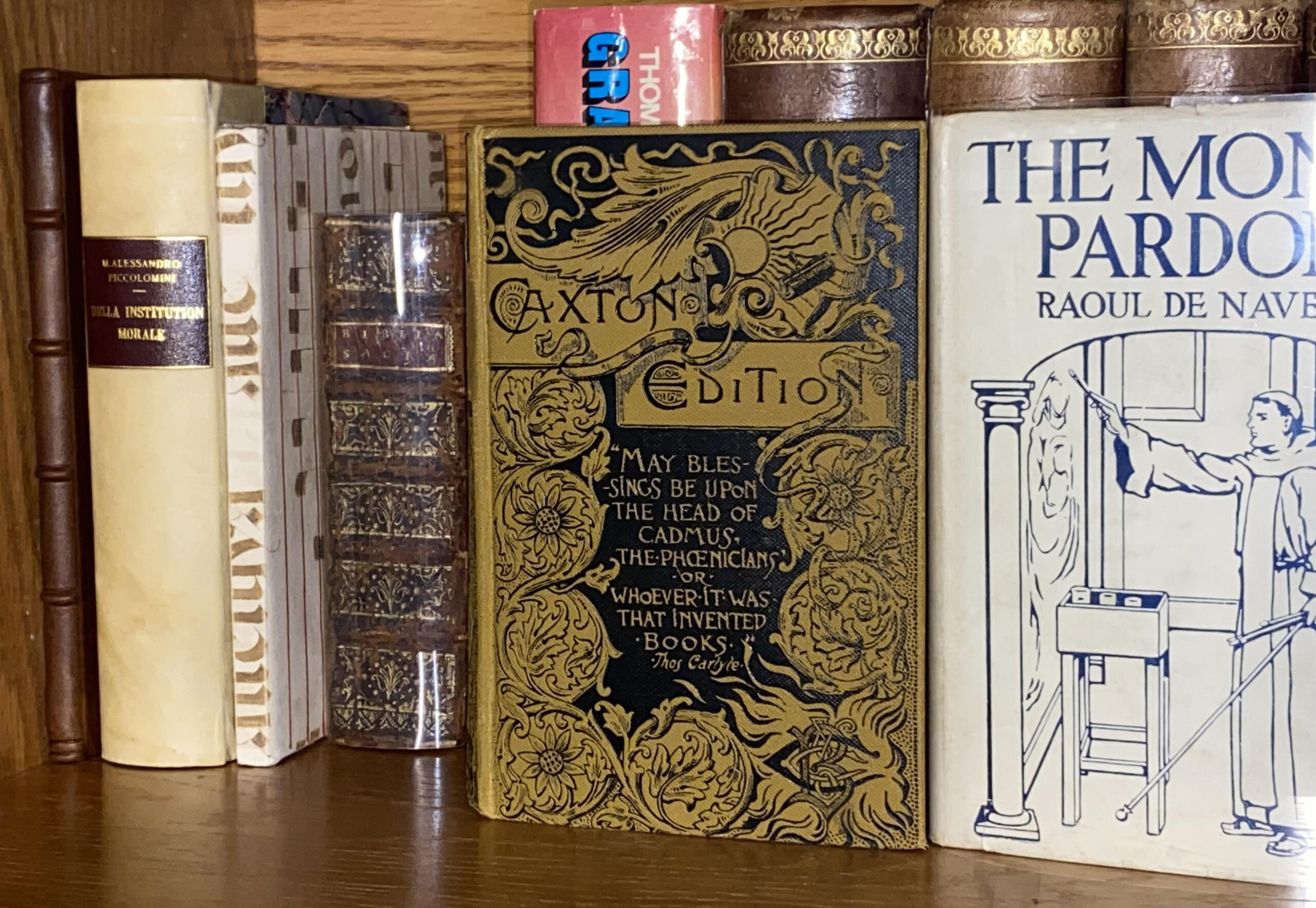

Rare books are more than relics of the past—they are investments that combine historical significance with financial potential. In a world where markets are increasingly volatile, rare books offer a unique blend of stability, diversification, and cultural enrichment. Here’s why they deserve attention from collectors and investors alike.

Rare books have a long history of increasing in value. Iconic examples like the Gutenberg Bible and Shakespeare’s First Folio have commanded multimillion-dollar prices, with values continuing to rise due to their rarity and importance. Even lesser-known titles with limited print runs or unique provenance can grow significantly in worth, especially when well-preserved.

As tangible assets, rare books provide a buffer against inflation. During times of economic uncertainty, their value tends to remain stable or even increase, as demand for high-quality collectibles often grows. Unlike stocks or bonds, the value of rare books isn’t tied to financial market trends, making them a resilient and enduring asset.

In today’s interconnected financial systems, traditional portfolios can be vulnerable to market swings. Rare books offer an alternative investment that diversifies risk while adding stability. They allow investors to hedge against potential downturns while enjoying the unique advantage of a non-correlated asset class.

Rare books occupy a unique position as both financial assets and treasures of cultural heritage. Owning a rare book is an opportunity to hold a tangible piece of history—whether it’s a first edition of a literary classic, a signed copy by the author, or a centuries-old manuscript. For collectors, this dual value is both emotionally satisfying and financially rewarding.

The collectible market is experiencing a surge in popularity, fueled by renewed interest in tangible, historic assets. Rare books are at the forefront of this trend, especially as new collectors and investors discover their appeal. With their blend of rarity, beauty, and historical significance, rare books continue to attract attention from an expanding global audience.

For those intrigued by the prospect of investing in rare books, here are some strategies to consider:

Rare books offer a unique combination of financial potential, historical significance, and emotional value.

For those seeking to diversify their investments while preserving pieces of cultural history, they represent an unparalleled opportunity. Whether you’re a seasoned collector or a curious newcomer, rare books can be both a rewarding passion and a savvy investment strategy.

Explore the possibilities of rare book collecting and investing with platforms like Ageless Literature, where history and innovation converge to make literary treasures accessible to a global audience.

I am a writer, deeply immersed in the world of collecting and reading, where my passions and creative endeavors have converged to birth the creation of Ageless Literature.

Subscribe now to keep reading and get access to the full archive.

Comments (0)